Image used for representation only. File

| Photo Credit: Reuters

The rupee declined 8 paise to 87.40 against the U.S. dollar in early trade on Tuesday (March 4, 2025), weighed down by persistent foreign fund outflows and a prevailing liquidity deficit.

Forex traders said the ongoing uncertainty surrounding tariff imposition by the U.S. has left financial markets in flux. Moreover, the tariff chaos has injected volatility and uncertainty into the U.S. Dollar Index.

At the interbank foreign exchange, the rupee opened at 87.38, then fell to 87.40 against the American currency, registering a decline of 8 paise over its previous close.

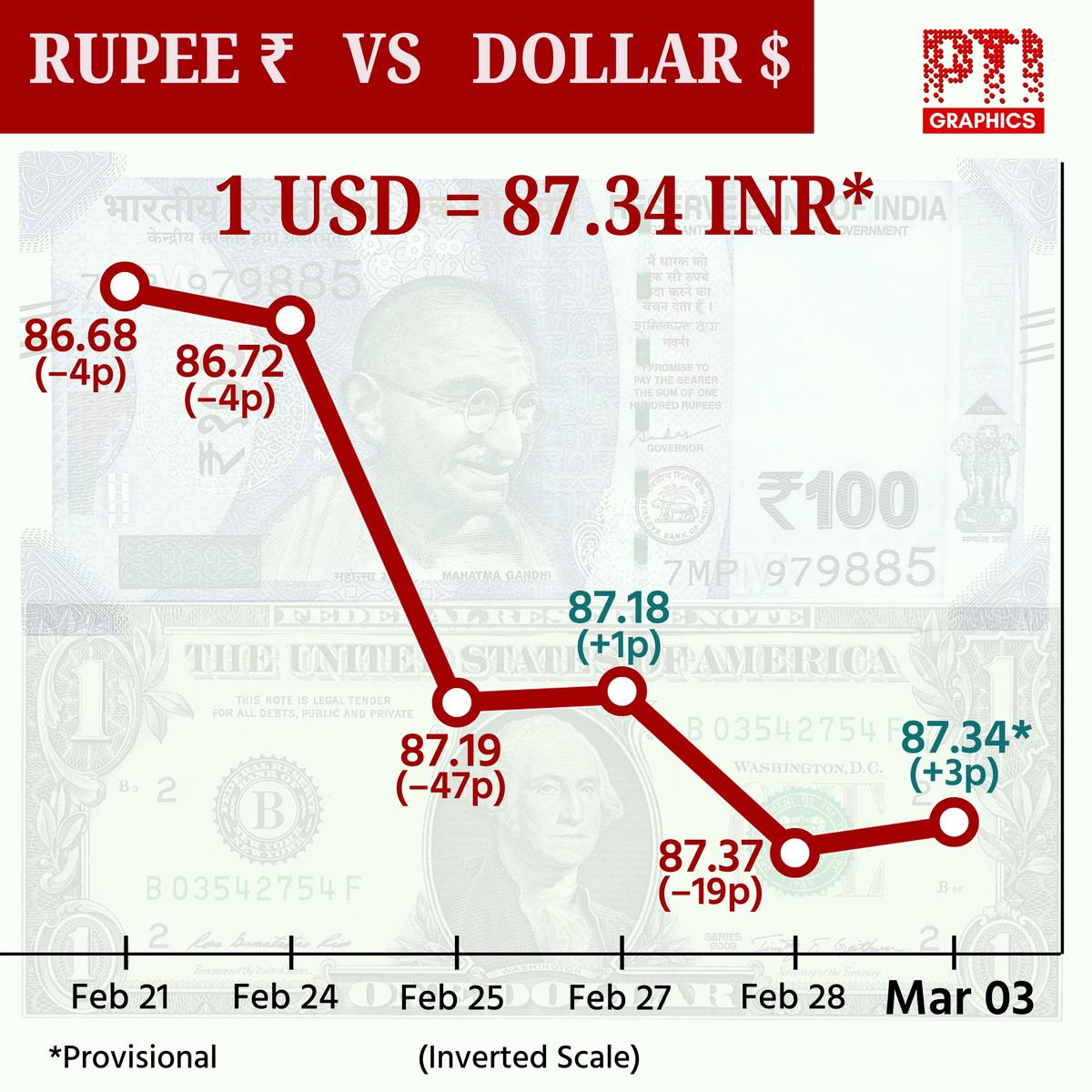

On Monday (March 3), the rupee settled with a gain of 5 paise at 87.32 against the U.S. dollar.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was at 106.61, lower by 0.12%, amid escalating trade tensions, which have been triggered by US. President Donald Trump’s renewed tariff policies.

Brent crude, the global oil benchmark, quoted 0.63% lower at $71.17 per barrel in futures trade.

In the domestic equity market, the 30-share BSE Sensex was trading 175.61 points or 0.24% lower at 72,910.33 in morning trade, while Nifty was lower by 61.55 points or 0.28% to 22,057.75.

Foreign Institutional Investors (FIIs) offloaded equities worth ₹4,788.29 crore in the capital markets on net basis on Monday (March 3), according to exchange data.

“With Nifty falling on a daily basis as FPIs continue to remain sellers, rupee is getting sold off with US dollar amidst demand on account of risk aversion,” said Anil Kumar Bhansali, Head of Treasury and Executive Director Finrex Treasury Advisors LLP.

On the global front, President Donald Trump said on Monday (March 3) that 25% taxes on imports from Mexico and Canada would start Tuesday (March 4).

Mr. Trump has said that the tariffs are to force Mexico and Canada to step up their fight against fentanyl trafficking and stop illegal immigration. He wants to eliminate the U.S.’ trade imbalances and push more factories to relocate in the United States.

“Markets reacted negatively to these developments, with concerns mounting over global trade stability,” CR Forex Advisors MD Amit Pabari said.

Published – March 04, 2025 11:23 am IST