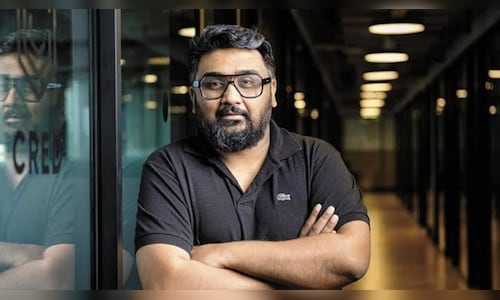

In an interview with CNBC-TV18, Founder Kunal Shah highlighted that CRED Cash+ offers a frictionless borrowing experience, enabling users to access funds without paperwork or human intervention.

“CRED Cash+ allows our members to borrow against their mutual funds in the most frictionless manner—without any documents and without having to deal with a human call or any of that stuff—almost in minutes, and get a very attractive interest rate, almost 8.99%,” he said.

The fintech firm’s move into secured credit aims to curb premature liquidations of mutual funds, a practice Shah believes hampers wealth creation. He noted that many users break their mutual funds or fixed deposits for short-term needs such as vacations or weddings, which disrupts the power of compounding.

“Mutual funds work when you keep compounding them versus breaking them for a temporary transaction. You lose that momentum completely,” Shah explained. “If you need money only for a short period—say, six months or two years—this product works well for you.”

Shah also highlighted that secured lending aligns with CRED’s long-term vision while benefiting consumers’ credit scores. Unlike personal loans that often come with higher interest rates (typically 15-16%), CRED Cash+ offers a lower-cost alternative with the added benefit of improving users’ creditworthiness.

While the launch coincides with a broader slowdown in the unsecured lending segment, Shah emphasised that the decision was not a reactionary move but rather the culmination of a long-term product development cycle.

“Most products at CRED are usually cooked and baked for many months, probably quarters, before we actually launch them. But the timing works well, as both our partners and consumers are shifting towards secured lending,” he said.

Shah pointed out that in more mature financial markets, 20-30% of mutual funds are leveraged, whereas in India, this figure remains below 1%. CRED aims to change that by making secured lending more accessible and mainstream.

Below are the excerpts of the interview.

Q: Finally, you’ve forayed into secured loans. This is something you spoke about the last time we had a conversation. Tell me, what prompted the move and why now?

Shah: It was something that was always there in our roadmap, but we wanted to create a user experience that feels magical. Let’s just understand the product first of all. CRED Cash+ basically allows our members to borrow against their mutual funds in the most frictionless manner—without any documents and without having to deal with a human call or any of that stuff—almost in minutes and get a very attractive interest rate, almost 8.99%.

The idea was that this was always considered an ultra-HNI product, where you typically saw big businessmen borrowing against their mutual funds or stocks and enjoying low interest rates. But we observed a very peculiar behaviour where members were breaking their mutual funds or FDs to fund, let’s say, a temporary vacation or a wedding in the family. That doesn’t make sense from a compounding perspective. Mutual funds work when you keep compounding them versus breaking them for, let’s say, a temporary transaction. You lose that momentum completely.

But let’s say you need money only for two years, one year, or six months. This product works well for them. We initially believed this was a use case only for business folks, but now we see it makes sense for every consumer. Instead of taking personal loans at 15–16% interest rates, they could get a much more attractive rate here. There’s no foreclosure, and with secured credit, their credit score improves, which actually works really well for our members.

Our model has always been clear: encourage good financial behaviour, ensure interest rates work for you and not against you.

Q: I understand the philosophy behind this—you want to provide a seamless experience to customers. Interestingly, this is also coming at a time when the unsecured segment is slowing down. I know you’ve said before that the segment you cater to is not impacted, but the fact of the matter is banks and NBFCs you partner with to give these loans are slowing down on the segment. Did that play a role?

Shah: I think it just coincidentally got timed around the same thing. We’ve been building this product for quite a long time. Most products at CRED are usually cooked and baked for many months, probably quarters, before we launch them.

The timing works well because, as you pointed out, our partners are quite ready to focus on secured lending. Creating a seamless experience across demat accounts and mutual fund portfolios—valuing them correctly, offering limits, and ensuring the best possible interest rates—requires integration effort. None of our partners had built these frictionless experiences before.

Our goal was to be at the forefront of this shift, as both the ecosystem and consumers are already moving in this direction. Also, our consumer segment has a large amount of AUM in mutual funds, yet we noticed that less than 1% of AUM was leveraged. In more mature markets, 20–30% of mutual funds are leveraged. Why should that not be the case here?

This model benefits credit scores, balances secured and unsecured lending for banks, and aligns with our long-term vision. But most importantly, is this the right thing for our members? The answer is absolutely yes. And that’s why we built it.

Q: Will there be some kind of FLDG involved with your partners, or how will you be offering this?

Shah: First of all, we do not participate in FLDG in most of our businesses. The reason is that we focus on high-affluent customers and low interest rates. FLDG is not a business model you will typically see in low-interest-rate businesses.

Secured lending, on the other hand, inherently carries minimal risk because the loan is backed by collateral. So FLDG is not a very prominent or pronounced factor in any secured lending business globally.

What we do is facilitate banks and NBFCs in offering these loans seamlessly on our platform. We earn a small fee for enabling this as a cross-sell opportunity on our platform. But there will be no FLDG in this category because of the nature of the product.

Q: You don’t really focus on revenues and certainly not profits. But with these additional product lines, could you give us a sense—when you’re offering starting interest rates of 8%—what kind of additional revenue do you hope this will unlock? And will we see more secured products from you in the future?

Shah: First of all, it’s not true that we are not focused on revenue and profit. However, we take a long-term approach to our business rather than trying to optimise for quarterly gains.

We are building a business that will outlast every single member at CRED. Therefore, the choices we make are much more long-term in nature. If something is right for the consumer but makes us less money in the short term, we are fine with that because, in the long run, earning their trust for two, three, or four decades will generate much more value.

We always focus on long-term revenues and long-term partnerships, including those with our lenders. In fact, we are probably the largest partner for most of them because we prioritise building sustainable relationships.

Building a long-term business in financial services may seem unexciting, but that’s the only way to do it right.

Watch the video for more